Long-Term Vision and Medium-Term Business Plan

As of May 23, 2024

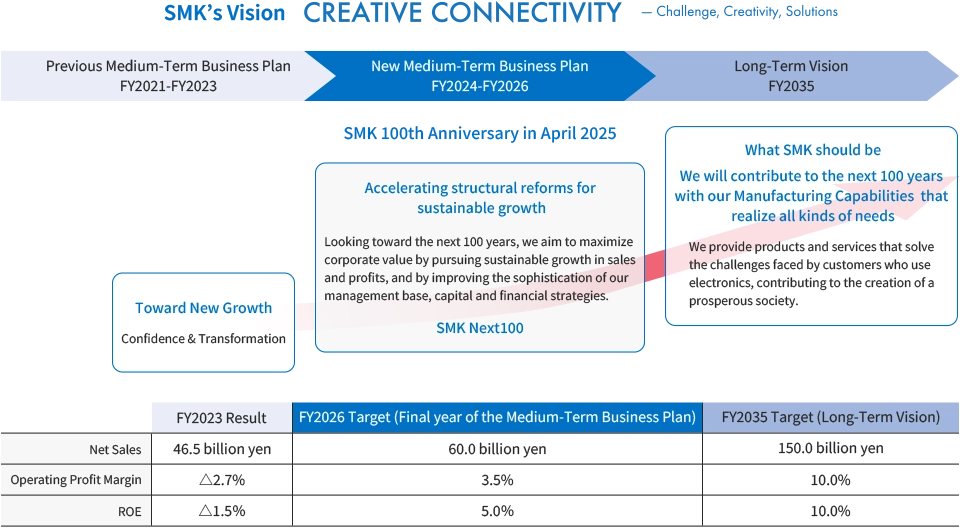

SMK will celebrate its 100th anniversary in April 2025. In preparation for the next 100 years of growth, we have clarified our Long-Term Vision for 2035. As a milestone toward achieving this vision, we have developed a Medium-Term Business Plan covering the period from FY2024 to FY2026.

Long-Term Vision (what SMK should be in 2035)

We will contribute to the next 100 years with our Manufacturing Capabilities that realize all kinds of needs

— We provide products and services that solve the challenges faced by customers who use electronics, contributing to the creation of a prosperous society. —

Since its founding in 1925, SMK has been providing electronic components to many customers, including electronics manufacturers, under the belief that "Good Parts Create Good Final Products." With the advancement of technology, the scope of electronics applications has expanded significantly. Based on the Manufacturing Capabilities we have developed over the years, we will continue to offer value-added products to all customers utilizing electronics by incorporating high-frequency technology, algorithm technology, and more. We will provide products and services that solve our customers' challenges, contributing to the creation of a prosperous society.

FY2035 Targets

| Net Sales | Operating Profit Margin | ROE |

|---|---|---|

| ¥150 billion | 10% | 10% |

Medium-Term Business Plan "SMK Next100"

As the first milestone toward achieving our Long-Term Vision, we have positioned the period from FY2024 to FY2026 as a time to accelerate structural reforms for sustainable growth and have developed a Medium-Term Business Plan. This plan focuses on resource investment and cost structure reforms aimed at returning to a growth trajectory for sales and profits, as well as strengthening the management base.

Basic Policy

Based on the promotion of sustainable management, we will work to achieve sustainable growth in sales and profits, advance the sophistication of our management base, and enhance our capital and financial strategies, all aimed at maximizing corporate value.

-

1)

Achieve sustainable growth in sales and profits

-

2)

Strengthen the management base that supports business

-

3)

Sophisticate capital and financial strategies

-

4)

Promote ESG & sustainability management

Growth Strategy

CS Division

- Expand sales and improve profitability in focus markets

-

-

Expand orders in car electronics, renewable energy, and wearable markets based on existing businesses.

-

Improve product reliability and quality through simulation in product development.

-

Increase profitability through automation and smart manufacturing at production sites.

-

SCI Division

- Enhance profitability and return to a growth path

-

-

Expand orders through further market penetration and new customer acquisition in the car electronics and housing equipment markets.

-

Create next-generation core products by integrating sensing technology with existing technologies.

-

Increase profitability through automation, smart manufacturing, and optimization of production systems.

-

Innovation Center

- Create new businesses through in-house technologies and Open Innovation

-

-

Promote the development of solutions by combining communication modules, sensors, and proprietary algorithms.

-

Launch new businesses in the healthcare market by utilizing open innovation.

-

Strengthening of the Management Base

To realize the above growth strategy, we restructured the organization into an integrated production and sales system centered around the Product Divisions as of April 1, 2024. We will further enhance the expertise of our salespersons and strengthen our solution proposals tailored to meet customer needs. Additionally, we will progressively implement a management framework based on ROIC and practice management that takes into account capital costs and stock prices.

Medium-Term Targets (FY2024-FY2026)

| FY2023 (Result) | FY2024 (Forecast) | FY2025 (Target) | FY2026 (Target) | |

|---|---|---|---|---|

| Net Sales (¥ millions) |

46,522 | 50,000 | 52,000 | 60,000 |

| Operating Profit (¥ millions) |

△1,243 | △200 | 700 | 2,100 |

| Operating Profit Margin (%) |

△2.7 | △0.4 | 1.3 | 3.5 |

| ROE (%) |

△1.5 | 5.0% in the final fiscal year | ||

| Capital Expenditure (¥ millions) |

2,290 | 2,600 | 2,900 | 3,700 |

| Exchange Rate (1US$=) |

¥144.56 | ¥150.00 | ¥130.00 | ¥130.00 |

Shareholder Return Policy

During the current Medium-Term Business Plan period, we aim for shareholder returns by combining dividends targeting a DOE of approx. 2% and flexible share buybacks based on business performance, with the premise of maintaining financial soundness in response to changes in the business environment.