Corporate Governance

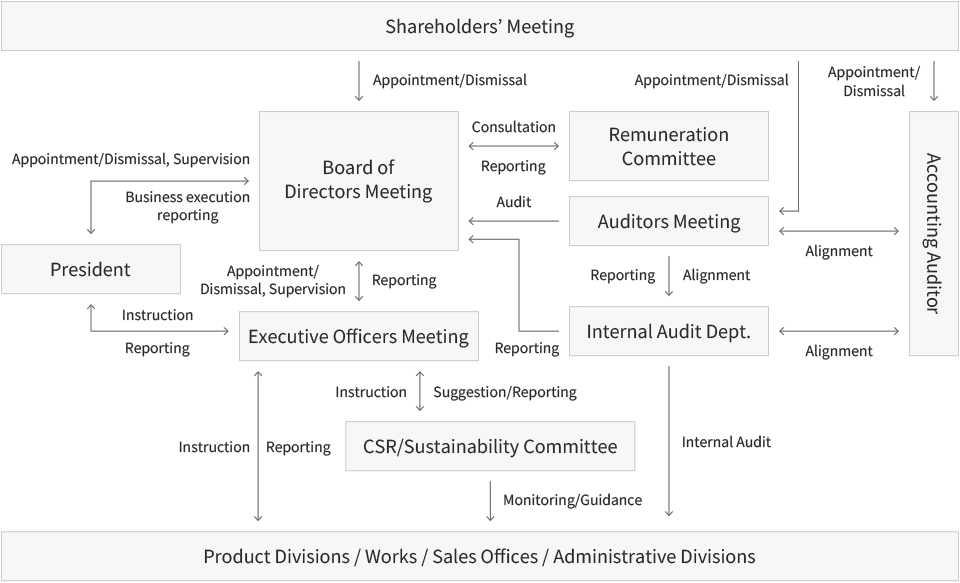

Corporate Governance Structure

SMK regards corporate governance as the development and operation of a system to achieve sound and effective management, and is working to enhance and strengthen it.

In April 2002, SMK introduced an Executive Officer and Outside Director system. Clearly separating the Board of Directors, which is responsible for management decision making and business supervision, from the functions of Executive Officers, who are responsible for business execution, creates a system that allows management responsibility to be clarified and speedy management decisions to be made.

Furthermore, Board of Auditors is made up of three auditors, two of whom are Outside Auditors who supervise Directors' performance of duty from an objective standpoint. The Remuneration Committee was set up in January 2022 to ensure fairness, transparency, and objectivity of Directors' remuneration.

SMK has submitted Internal Control Report to authorities from June 2009 to improve internal administration, complying with the Internal Control Reporting System based on the Financial Instruments and Exchange Act effective in 2008.

Evaluation of Board Effectiveness

SMK conducts an annual self-evaluation to assess and enhance the effectiveness of the Board of Directors, aiming to increase corporate value. We administer a questionnaire to board members regarding the roles and functions of the Board, Board composition, meeting operations, content of discussions, coordination and support framework, relationships with shareholders, and follow-up on issues identified in the previous evaluation. The results are then discussed at the Board of Directors Meeting. For the evaluation results for FY2024 and our future initiatives, please refer to the PDF below.

Based on these results, we will continue our efforts to enhance the board effectiveness and further strengthen corporate governance.

Policy on Constructive Dialogue with Shareholders

SMK promotes constructive dialogue with shareholders and investors based on the following policy:

-

1.

The Financial Planning Dept. serves as the main contact for dialogue with shareholders, with the officer in charge of Investor Relations (IR) overseeing the process. The Financial Planning Dept. organizes the necessary information for IR activities, working with departments such as the Corporate Planning Dept. and Product Divisions.

-

2.

In addition to individual meetings, SMK holds semi-annual investor briefings as a means of dialogue.

-

3.

Opinions gathered during dialogues with shareholders are reported to the Board of Directors and relevant departments when necessary.

-

4.

To appropriately manage insider information, SMK establishes a quiet period before the release of financial results, during which certain dialogues are restricted.